Gen Zs and millennials don’t resonate with jargon-heavy, technical messages of traditional banks. Can social media marketing for fintech open a new pathway?

Social media is one of the most sought-after marketing channels after email today. It’s curated and interactive.

Isn’t that only a single part of the picture?

There are bits not as vibrant as Instagram or as openly opinionated as X.

And that’s where we must look. The remaining 50-40%. That’s what businesses leverage it for. They want perspective and nuance that they don’t find on other channels, even their own websites.

Social media has undoubtedly become an avenue to dissect some of the most pressing matters.

That’s why these platforms have become the molecules of marketing. It’s true for the overall market. However, financial institutions are still catching up.

The advantage of social media marketing for financial services is obvious.

It’s a communication tool. A customer listening medium. Opinion gatherer. Especially for financial products that are complex and too intricate to crack open.

The products aren’t as desirable as a designer bag or a car. But they’re extensive. And that’s why most financial institutions assume product-centricity in their marketing tactics.

That’s limiting their reach. And market growth. And their exposure.

So, financial institutions must pivot- better understand customers. And reiterate what marketing is to them.

Why is Social Media Marketing for Fintech Vital?

The whole lot of marketing has been oversimplified into a single function. The nuance? Gone. Erased. And replaced by tech. Even though that wasn’t the primary intention. It was unintentional, but it drives the boat.

It’s because businesses and marketers haven’t understood where to adopt tech. Specifically, beyond the mechanical requirements of marketing operations. Their eyes are only set on audience engagement and trust building.

This is true for almost every industry. But what if we topple the perspective?

These are KPIs for your business. Not for your buyers. For those purchasing your solutions.

In most cases, the buyer’s perspective is still missing. Customer knowledge is limited or neglected. Product-centricity could elevate your sales. But it won’t offer perspective on what’s working and what isn’t. You’re losing on long-term sustainability this way.

But those who do (your competitors) will zoom past you.

How can financial institutions navigate this?

Let’s start with the basics.

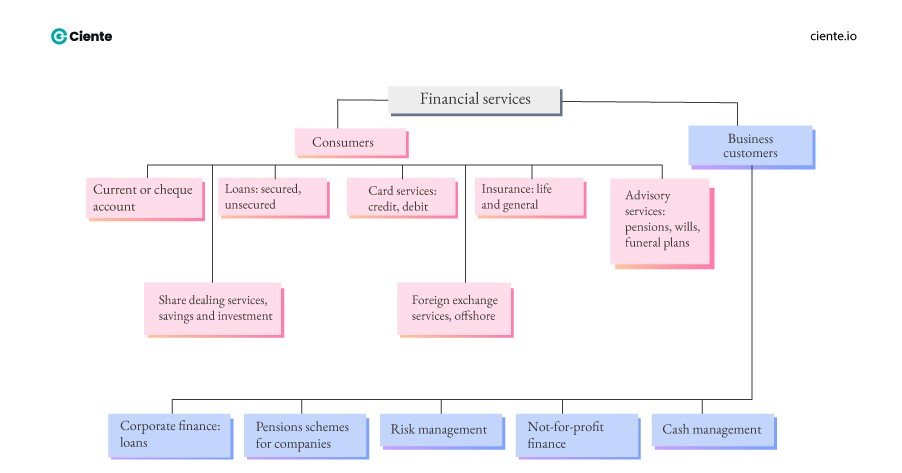

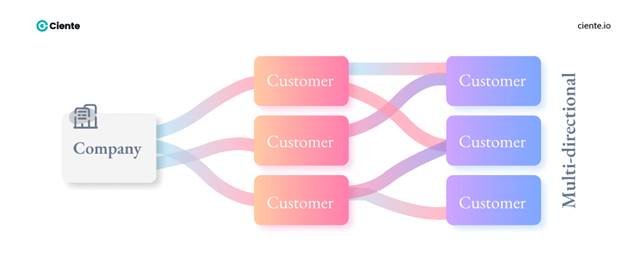

Financial institutions hold their customers’ current accounts. So, basically, they should be in a better position to grasp what they need. It’s not just a clear-cut understanding. It’s about the multi-facetedness.

The opinions and experiences of those who leverage these financial services. For FIs to be able to orchestrate interaction strategies and solutions that cater specifically to different audience segments. And to the customers of the future.

That’s the crucial difference in finance. It’s not just for the ‘now’ but the faraway future, too. And the solutions and messaging must reflect it.

A Case for Social Media Marketing in Fintech: Cash App Fridays

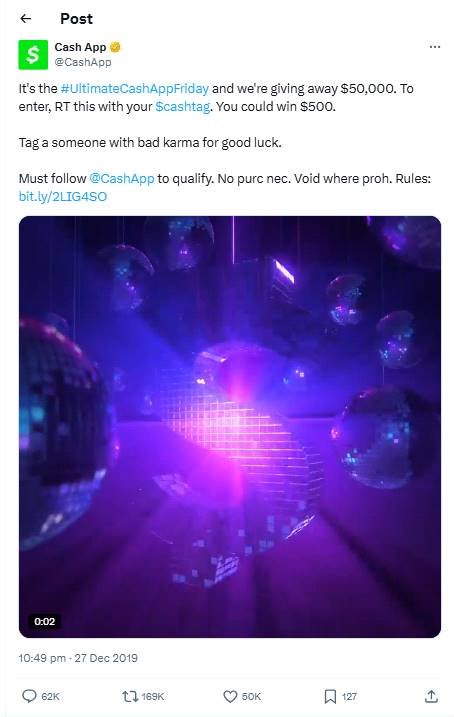

Think of CashApp’s 2020 viral “Cash App Fridays” moment.

Remember how viral it got on social media. And how its active users skyrocketed to 24 million, in the US alone.

Mobile payments are perceived as burdensome. Because who likes money getting debited from their accounts? But CashApp flipped the world of mobile payments on its head.

Turning it into a viral social media sensation. It didn’t merely have users talking about money- they even started sharing it. The brand encouraged its audience to retweet CashApp’s tweet with their $Cashtag usernames to win exciting cash prizes. It got the audience rushing to participate.

It wasn’t a simple giveaway. It was a viral moment that brought substantial awareness to Cash App. A brand that wanted to proclaim that fintech doesn’t need to be boring. The impact?

50k+ retweets, likes, and comments. And its annual net revenue grew to $1.11 billion- almost 157% year-on-year.

Fintech can be fun, and it was. But what Cash App did was not merely offer financial incentives and discounts to its users. It churned users into its brand story.

That was social media marketing in fintech done absolutely right.

You can’t think of financial services as isolated from those who leverage them. The products might be complicated to penetrate. But thousands and millions of people leverage them- individuals and businesses.

The Takeaway?

You can’t remove your audience from your story. Specifically, to centre only your product.

What a fintech social media campaign required- Cash App’s campaign had it. It amalgamated fun and financial value. It created a buzz while attracting organic sharing and meaningful engagement.

And turned mundane transactions into a social sharing event.

This has transformed fintech marketing forever. Especially how fintech companies interact with their audiences and encourage them to interact with their platforms in return. Something in return for nothing. This single marketing gimmick put Cash App on the map.

Merely because it invited its audience to be a part of a community. That’s why it’s still trendy and reaping fruits for Cash App and its users even today.

Social media marketing spotlights the business’s potential as it did in Cash App’s case.

Social Media Marketing for Fintech: The Hidden Psychology

Normal users saw an opportunity, but Cash App saw endless customer data and behavior that they could study. What delights customers and what leaves them satisfied- a real-time campaign feedback.

But hold your horses. There’s another vital reason why fintech must leverage social media.

First, it decodes your business for your end-user. Not through your complicated products and messaging, but in a more stripped-down attire. Here, marketing’s potential shines through.

Second, you receive access to distinct demographics, especially the younger generations making up today’s investor base.

And lastly, it can help you navigate a significant pain point for both fintech companies and their customers: security.

Users are cautious when it comes to anything that includes a monetary debit or credit. Because with the digitization of banking, there’s been a surge in malicious actors. Especially cyber attacks and data threats. Customers aren’t ready to partake in any exchange unless there’s enough evidence (proof and credibility) of the other party.

But Cash App’s social media tactic was a trust-building movement. Customers seamlessly participated in the campaign. Specifically because it didn’t merely include monetary exchange. It promised value and entertainment- two facets on opposite spectrums in the finance industry.

And through this campaign, users who were hesitating to use the app before found confidence and safety in leveraging it.

Isn’t that marketing’s purpose? To make customers feel confident in the decision they’re making. Give them clarity, confidence, and convenience. That’s precisely what Cash App did.

But it only works when you’ve a social media marketing strategy in place.

The Tiny Dos and Don’ts for Your Fintech’s Social Media Marketing

These viral moments don’t happen on a whim. They are planned, curated, and executed. And as a fintech company, do you want to be on socials because that’s the trend right now?

Chasing coattails will not get you anywhere. We’ve established that product differentiation for financial services is at an all-time low.

So, think. Think: why do you want your fintech brand to be on social media?

Is it exposure, customer service, or engagement?

You’ve a disruptive financial solution. So, shouldn’t your social media showcase that?

Treat your social channel differently.

The thing is, social media is for unbiased communication to shine through even the most rigid barriers. It makes it easier for brands to penetrate different audience segments. But will you really get any results if you’re talking about your solutions and the amazing offers?

It’s a downright no.

Where’s the value for the platform and those who are most likely to follow you?

Your page should reflect that. Don’t do social media for clout. Do it to provide value to your customers and build your brand- an image apart from the platform for monetary exchange.

As financial services become digital-first, social media will hold the power to either mislead or empower its customers.

Customer inertia in financial services is slow. Financial consumers take years to change their service providers. It’s a known fact, especially across emerging markets.

Customers are generally drawn towards established and enduring financial institutions. Ones seen as the bullwarks of stability during market volatility. But this purview is changing.

Fintech is having its moment. It has transformed how customers save, exchange, store, and spend money.

But people continue to be scared. Finance management is no joke.

However, fintech brands are hoping social media marketing can change that. They want to seem as the promising alternatives to banks, but not desperate. They want to instill trust in customers. And long-term sustainability through economic and credit cycles.

Be enduring brands.

That’s what social media marketing for fintech must do- be this channel of communication and offer new value to its customers.

All the while acting as the bridge of trust.