Growth without discipline is a countdown. Align operating truth with capital power, and you stop playing defense. You build an organization that endures.

Some numbers don’t just move investors. They also offer a sturdy spine to your business to help it sustain and thrive in the next quarter. But it’s a bit more complicated for SaaS companies.

Revenue is gauged over an extended period when it comes to SaaS businesses. It’s not immediate.

If you retain your customers for a long time, well and good. That one customer becomes profitable for you for the long haul. But if you leave the existing ones dissatisfied, they’ll churn. And the return on the investment you made to acquire those customers.

The losses are immense. And the reason SaaS growth faces a cash flow issue.

The faster they burn to grow the company ⇒ The losses increase. At what moment do they hit the brakes or accelerate?

This is what SaaS metrics tell them. These tell them a story.

But most investors and board members don’t realize this. They focus on vanity metrics. numbers that appear impressive but often contradict real B2B SaaS funnel conversion benchmarks. This one-dimensionality is a setback. They ring hollow.

They might signify one thing on their own. And another, given the bigger picture.

The Rule of 40 (of the 40% rule) is the best example.

It’s a crucial symbol of business leaders. Especially to gauge the organization’s current financial state and viability. It’s meant to strike a sweet balance between two facets that a SaaS company barely has at a single time: growth and profitability. the same tension leaders face when planning SaaS marketing budgets in 2026.

This was specifically to spotlight companies that could make money (or at least not lose a chunk of it at a time) and grow at the same time. It isn’t about the durability of business. It’s merely a short-term health check-up.

The Rule of 40 tells you that your engine’s running well. Not that you’ve got flat tires. Or that you’re about to run out of gas.

And honestly? That’s short-sighted.

This isn’t the metric that your investors will actually care about.

And for your business’s sustainability? Neither should you invest your resources merely into a single metric. No fail-safe will work out for you in the blink of an eye.

What Precisely are SaaS Metrics?

HubSpot defines SaaS metrics as:

“SaaS metrics are the key performance data that software-as-a-service companies monitor to measure growth, retention, and customer satisfaction over time.”

These basically tell you (or show you) what’s going on. They don’t merely help you forecast your business’s potential revenue. But studies its health, growth, and success rate.

SaaS metrics offer a bird’s-eye view into how marketing, sales, customer success, and product development are doing. To win over potential investors. And be answerable to existing ones.

Common SaaS Metrics that the SaaS Industry Cares About

There are numeric thresholds that plague the market. They matter. But over-reliance on a single model and theoretical proof isn’t sustainable. The mundane SaaS metrics reflect your potential. It doesn’t show you how to thrive.

Good SaaS metrics don’t mean much when revenue is uncertain, and churn is volatile. The polished slide decks prove nothing.

They represent the leaks. But they also spotlight the leaking spots. You only need them under your control. Weakness can turn into an opportunity when perspective changes. It’s not merely about having a strategy or metrics in hand, but what you do with them.

It’s the quality of execution that drives the boat. Your SaaS metrics + operational maturity.

Especially to navigate any fragile spots.

This begs the question: what are these SaaS metrics we’re circling?

Let’s get into them. These are the common ones- ones that matter and should matter to you.

1. Customer churn

Churn isn’t a metric. It’s a verdict.

A quiet execution of the belief that your product wasn’t worth sticking around for. Companies obsess over new pipeline and top-line ARR. But churn is the purest signal of product-market fit because it exposes the gap between what you promised and what the customer actually experienced.

It tells the world whether your growth is real or whether you’re filling a leaking bucket.

High churn drains cash, suffocates momentum, and forces companies to depend on expensive capital. which is why reducing churn in SaaS is a strategic imperative, not just a customer success initiative. Investors treat poor retention like radioactivity- not because the number is bad, but because it signals instability.

If customers aren’t expanding, they’re already walking out the door.

Churn is a mirror. You either face it or die pretending.

i. New customer churn

Early churn is the purest signal. It exposes onboarding failures, ICP confusion, and hollow messaging. If customers churn within 90 days, it means they never saw value.

That’s not churn– it’s rejection.

2. Burn multiple

Burn multiple measures to determine how efficiently a company converts cash burn into net new ARR. In simple terms: how much fire does it take to forge a dollar of growth?

If you’re burning $1M to add $1M ARR, that’s a burn multiple of 1.0. If you’re burning $3M for the same result, something fundamental is broken.

In the era of cheap money, burn was invisible- masked by froth and vanity valuations. But now?

Burn multiple is a character test.

It separates operators from dreamers. High burn means weak discipline, unstable unit economics, and a runway controlled by investors instead of your own will. Low burn means leverage. It means you can wait out markets and choose capital on your terms, not someone else’s urgency.

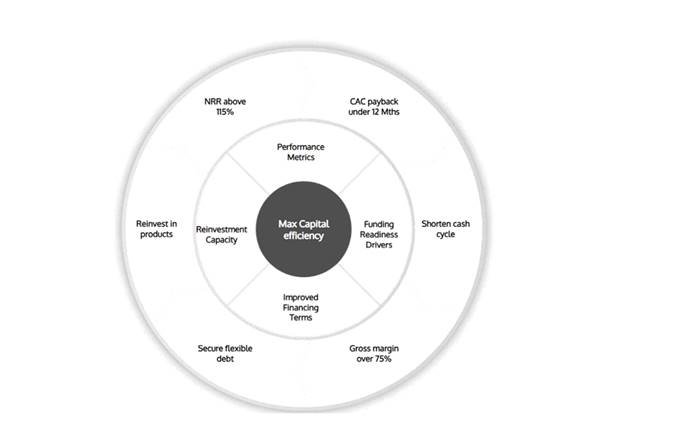

Burn multiple ties directly into the Capital Efficiency Flywheel.

3. Natural rate of growth

Natural growth is the growth you earn without artificial force, without paid marketing, aggressive outbound, or heavy discounting. Often powered by strong SaaS inbound marketing foundations. It is expansion revenue, product virality, network effects, and organic referrals. It is the gravitational pull of real value.

In a healthy SaaS machine, natural growth is the backbone of capital efficiency.

When your base grows, CAC falls, NRR rises, and the flywheel gains momentum without external capital dependency. That’s how you build a company that compounds. When natural growth is weak, you must spend aggressively to maintain motion.

And that’s when dependence on risky, expensive capital begins.

Natural growth is the truth serum of product quality. If you have to shout to be heard, your product isn’t resonating. If customers expand without you asking, you’re building something inevitable.

4. Activation velocity

Activation velocity measures how fast a new user reaches their first moment of real value. Time-to-value is the battlefield. The longer it takes, the more interest decays, the more doubt grows, and the faster churn sharpens its blade.

The speed of activation determines whether the user becomes invested or ghosts you. Every extra hour in onboarding, every unclear step, every pointless form is an opportunity for regret to surface. You aren’t just fighting friction- you’re fighting human impatience.

Faster activation means quicker adoption, which drives expansion, which improves NRR. Better NRR unlocks better financing, lowers dilution, extends runway, and strengthens the flywheel.

5. Revenue churn

Revenue churn tracks how much recurring revenue you lose from downgrades and cancellations.

If logo churn is losing customers, revenue churn is losing belief in value. It exposes whether customers are shrinking rather than expanding, whether they’re retreating from commitment. And whether usage is flattening or decaying.

Revenue churn is the inverse of momentum. High revenue churn means your business is sprinting uphill wearing weights. Every dollar lost must be replaced before growth can even begin. That’s how companies end up in treadmill mode- running fast, going nowhere.

Solving revenue churn demands understanding not just why customers leave but why they reduce spending. Sometimes the enemy isn’t competition. Sometimes it’s a lack of adoption depth, misaligned pricing, poor usage segmentation, or shallow value creation.

Revenue churn tells you whether your product becomes more or less valuable over a period.

6. Customer acquisition cost (CAC)

Customer acquisition cost is the total cost required to acquire a new paying customer, and it reflects how efficient your lead generation for SaaS engine truly is. But CAC is misunderstood. It’s not a marketing metric. It’s a capital allocation signal. CAC tells you whether the fuel you burn creates propulsion or smoke.

High CAC isn’t always bad.

High CAC, succeeded by fast payback and high NRR, is powerful. Low CAC with high churn is a lie. The real question is how efficiently your marketing spend converts into durable, expanding revenue.

It forces you to face uncomfortable questions like:

- Are we selling to the right customers?

- Are we relying on artificial channels because your product doesn’t reach organically?

- Is your funnel built on persuasion over proof?

7. Customer lifetime value

Customer lifetime value (CLV) represents the total revenue a customer generates over their subscription period.

But more importantly, it represents the depth of transformation your product creates. Shallow value means short life. Deep value means compounding revenue.

In an efficiency-first world, CLV is a weapon. It dictates how aggressively you can invest in acquisition, how resilient your revenue base is, and whether external capital becomes an amplifier or a crutch.

CLV is where truth hides.

High CLV signals strength and maturity. Low CLV signals fragility and dependence. Investors know the difference. That’s why CLV drives valuation more than growth rate.

The flywheel lives or dies on the longevity of revenue. If customers don’t stay long enough or expand deeply enough, the wheel never turns.

8. CLV-to-CAC ratio

The CLV-to-CAC ratio answers one question for you: Is this account worth it?

How many dollars do you get back over time for every dollar you spend to acquire a customer? A ratio below 3:1 means your model bleeds efficiency and demands capital to stay alive. A ratio above 5:1 is a signal of control and leverage.

But the trap is celebrating this number without understanding its composition. You can inflate CLV through optimistic assumptions. You can deflate CAC through selective accounting. Vanity ratios don’t fool lenders. They read cash behavior, not PowerPoint slides.

The real meaning of CLV/CAC is alignment.

The tighter your acquisition engine and retention engine connect, the faster capital compounds.

9. Net promoter score (NPS)

NPS measures a customer’s willingness to recommend your offering. But beneath the number lies something raw: emotional conviction. NPS isn’t about satisfaction- it’s about advocacy.

High NPS signifies your product has become part of the user’s identity. Low NPS means indifference. And indifference is death disguised as silence. Customers rarely churn loudly. They churn emotionally long before financially. NPS is often the first signal.

The danger is treating NPS like a survey metric rather than a battlefield report. If you ask customers for feedback but ignore their scars, NPS becomes theater. Real operators hunt the anger, not the compliments.

Investors value NPS because it predicts expansion and organic growth. a theme echoed in forward-looking SaaS marketing insights for 2026. High NPS means natural growth. Natural growth means lower CAC. Lower CAC means negotiating power. Power means better capital terms.

NPS is about loyalty. Loyalty is earned in blood through relentless value, actual outcomes, and transformed identity.

10. Customer engagement score

Engagement is the pulse of a product’s soul. It shows whether customers are living inside your product or merely visiting. High engagement means your product is woven into daily workflow. Low engagement means churn is already loading its bullet.

Engagement matters because it predicts everything- renewals, expansion, upsell, advocacy, onboarding effectiveness, product relevancy. It is a leading indicator. Revenue metrics trail it.

Tracking logins isn’t engagement. Tracking feature usage isn’t enough. Engagement is about depth, frequency, breadth, and behavioral dependency:

Would their world break if your product disappeared tomorrow?

If the answer is no, the relationship is temporary.

Engagement score forces honesty. It reveals whether value lives in your marketing or inside the product experience.

11. Qualified marketing traffic

Traffic means nothing. Qualified traffic showcases intent. something only a focused SEO for SaaS strategy can consistently deliver. Anyone can buy clicks. Few can attract commitment. Qualified traffic signals that your message is reaching the right minds at the right moment with the right problem.

The world is drowning in volume. Strategy is precision. The companies winning today aren’t shouting louder- they’re speaking to fewer people more clearly.

Qualified traffic determines CAC efficiency. A funnel fed by noise inflates spending, slows sales velocity, and forces companies to raise capital out of weakness.

12. Lead-to-customer rate

This metric reveals the efficiency of your conversion engine.

How many leads actually become paying customers? It exposes whether your demand engine is aligned with your ICP, whether your sales process is sharp, and whether the gap between desire and purchase is frictionless or fatal.

A strong conversion rate lowers CAC and compresses payback. A weak one inflates burn, forces desperate pipeline growth, and drives dependency on capital.

Conversion rate is a story of coherence:

- Does your product deliver the value your messaging promises?

- Does your sales motion match customer readiness?

- Are objections real or manufactured by confusion?

13. Leads by lifecycle stage

This metric breaks leads into stages: awareness, engaged, qualified, sales-ready, committed, customer. It forces you to understand not just volume but progression. Movement through stages reveals whether the system is alive or stuck.

If leads stagnate in one stage, something is broken- messaging, targeting, timing, pricing, or onboarding expectation. Companies that ignore lifecycle progress build giant top-of-funnel machines that convert nothing.

Lifecycle leads reveal momentum. Momentum is everything. Investors don’t fund dreams but velocity. Lenders don’t trust aspiration. They trust predictability. Lifecycle movement proves both.

This metric ties directly to the flywheel because it exposes conversion health across time. Fixing friction at any stage strengthens CAC efficiency, speeds CAC payback, and improves cash flow velocity.

Why Having the Correct SaaS Metrics in Your Pocket Matters

This 40% rule doesn’t get nuance.

You can also invest chunks into a large-scale one-time ad campaign. But if you keep on losing 20% of your customers each year, your business model is unstable. Even though the growth rate is 50%.

It’s a standalone metric good for helping leadership decide where to invest. Your potential investors need to know the risk levels before funding you. Or gauge your company’s multiple. Because the funding you receive severely depends on your SaaS business’s capability to recover from the cost of acquiring customers.

CAC payback is a huge deal. But that’s not all you can rely on.

Numbers can be manipulated. Businesses can easily choose one or the other as long as the total remains 40% or even exceeds it. This is why most jump to getting in new sales over focusing on retention numbers. Whatever floats their boat.

But with a leaky bucket- high customer acquisition but higher customer churn, the boat doesn’t row too far. And there are metrics that investors still perceive as risky. You can have good payback but have high customer concentration and burn multiple.

It’s easy to become desperate at this hour and try to prove your worth to potential investors. Only to accept funding on bad terms. That becomes your Horcrux.

There are a whole lot of downsides to accepting investments that are in bad faith. High cost of capital. Early dilution. Operational restrictions. Strict covenants. Loss of ownership.

That’s why SaaS companies need a diagnosis. Not a health check-up.

But that demands knowing what to check for. In this case? Strong metrics. Ones that connect financing with unit economics. That’s what SaaS demands.

Crux of Choosing the Right SaaS Metrics: Align Operational Performance and Financing

Another mistake that most SaaS companies make is sticking to unit economics. They live and die by it. This means how each customer (a unit) affects the long-term financial performance. They often leverage the “unit-as-a-customer” model.

Again, it’s crucial to gauge the viability of your business model. It tells you how efficiently you turn investments into growth and profits.

The number can look great on the outside, but your SaaS company can still fail. Especially when you don’t receive capital on good terms, or you burn multiple surges. You burn cash faster than you resuscitate it in revenue.

However, if not tied to a capital strategy, it’s grossly insufficient.

That’s why it isn’t all that your potential investors care about. CAC payback might run the show. But it has to be taken in context with other SaaS metrics such as customer churn and Net Revenue Rate (NRR).

SaaS business models are complex. And they depend on unique metrics such as ARR, MRR, NRR, subscription gross margins, unlike other industrial domains. Each metric must correspond with the others. They can’t exist in a vacuum.

You need a unique stack of SaaS metrics that actually matters- to both you and your potential investors.

- Faster CAC payback

- Strong customer retention

- Stable margins

The truth is that great metrics don’t guarantee survival. Alignment does.

When operational performance and capital strategy reinforce each other and don’t clash, the flywheel turns. That’s where power is built.

Because in the end, SaaS doesn’t fail from slow growth. But from focusing on the nitty-gritty that holds no sustainable value.