Softbank’s sudden exit from NVIDIA isn’t the financial giant cleaning its hands of AI. It’s merely revamping its investment strategies.

There has been rampant speculation (and sure-shot statements) about the AI bubble. But only a few in the market have really gauged if AI is truly creating a bubble, or it’s merely a precaution, a way of being cautious after the dot-com bubble.

Each different quarter this year has flagged down a warning that this potential bubble could burst. And send all of us toppling- the G7 have no long-term, sustainable AI model in sight. But they continue to invest billions of dollars into artificial intelligence.

Hearing of Softbank selling its stakes in NVIDIA for $5.8bn sent shivers down the market.

But it isn’t giving up on AI just yet. The financial institution is merely doubling down on OpenAI, which it believes holds more promise. Especially after it reported $15.99 billion in valuation gains driven by its OpenAI holdings.

Why?

For Softbank, its investment in OpenAI is more substantial. It’s also freeing up more assets to further invest in new avenues. And diversify its portfolio after they made a $30bn investment in OpenAI.

According to a few market analysts, it’s not as if Softbank is abandoning the AI route. It is still the shiny, glossy plaything. Only that the finance giant could have found newer toys, which it believes hold more potential than NVIDIA.

“Investors typically sell out of positions when they believe the valuation is too rich, the growth prospects for the company are less attractive than before, or they’ve found something better to back and need cash to make that investment,” chimed in AJ Bell’s investment director.

And further on, attempted to justify this sudden shift–

“Nvidia’s role in an AI world is already well known, yet OpenAI’s position is still evolving, so it might simply be that SoftBank sees the latter as a better way of profiting from the tech explosion going forward, rather than sticking with yesterday’s trailblazer.”

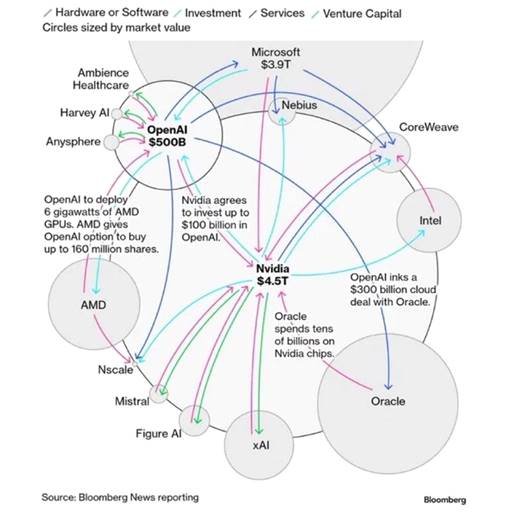

Honestly, there’s no stopping these institutions. So much so that the US’s economic model is now basically these seven giants sending a trillion dollars back and forth to each other.

Wired announcing that AI is the Bubble to Burst Them All, to Fortune declaring that “a collapse is definitely a possibility.” There are plenty of best-case scenarios that the tech leaders and investors are drumming up for you. And some are rosier than others.

But there’s no doubt when we say that all of these companies are tied together in financial deals that are ticking time bombs. Even the Big Short- Michael Burry, who rightly predicted the housing bubble of 2008, placed $1.1bn bets against NVIDIA and Palantir.

Isn’t this a strategic move, or is it all left to fate’s hands?

AI can be persuasive. But it’s all a gigantic mess, not merely a bubble.