Financial advice is primarily limited to phone calls and emails. But with fintech making splashes, will wealth management firms come out of their bubble?

Precisely in 2017, PwC published a four-part report on the impact of fintech. One of them outlined the launch of “robo-advisors” investment platforms across Italy. It was fundamental to assessing whether the financial world was ready for automated advisory solutions.

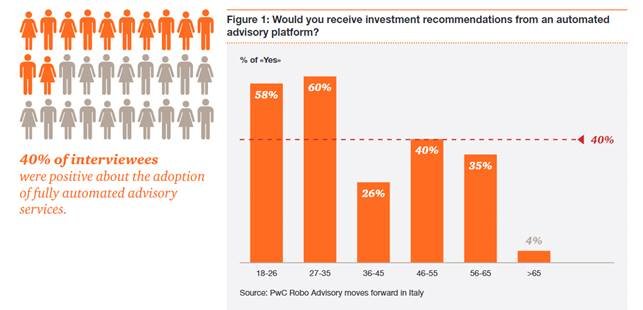

And the analysis graph looked something like this:

Source: [PwC]

Over 40% of the interviewees positively feel that the future of investment advice will be automated. That was the basic conclusion drawn over eight years ago.

And eight years later, financial institutions such as BlackRock and Charles Swab are amongst the first ones to incorporate robo-advisors into their portfolios.

But the survey also highlighted a hitch- one-size-fits-all advisory models wouldn’t cater to different customer profiles. And three different ones should be considered- traditional, multi-tasking, and intelligent. So, the underlying logic drifted strongly towards traditional advisory models. A few preferred banks opting for gradual digitization and automation to revamp this model.

However, eight years later, the demographics of the investors have changed. The same conclusion is deemed inconclusive today.

But we can’t blame the survey; it’s merely a comparison.

Wealth Management and Advisory Models: Targeting the Crux of the Problem

Automated advice, in the long term, didn’t hold a definitive face. And with investment performance and advisory services working in tandem, the expectations were always higher. Face-to-face carried more weight, and considering the risks, why shouldn’t it?

Fintech’s movement into wealth management was merely a whispered suggestion when this PwC report was published.

However, investor expectations today are afflicted with a generational gap. And at the center stage for the wealth management firms’ new clients are millennial investors. It’s a conundrum- the global wealth is shifting across generational demographics. While traditional wealth management firms wish to stick to old methodologies, with a few upgrades here and there, this creates a gap.

This doesn’t pair well with millennial investors’ requirements: faster, cheaper, and better service, with transparent fees and highly personalized advice. The impact of fintech on the wealth management industry is precisely about five customer-centric facets:

- speed

- quality

- accessibility

- efficacy

- convenience

But they’re skeptical whether traditional advisory models can meet these demands. After all, this generation is more tech-savvy, especially after they witnessed what is one of the worst financial crises in 2008.

This has left wealth management firms under duress — they’ll have to meet millennial investors’ needs, reinforcing why thought leadership in fintech is a priority for firms aiming to stand out. And they want to retain the people element, while leveraging tech to augment existing skills and services.

With the firms realizing this shift, they’re poised to enter a new era of value creation. Led by the front-running driver of this much-needed transformation: Fintech. Much like how businesses embrace digital-first models in other industries, wealth firms are undergoing similar shifts outlined in digital transformation strategies.

You can trace fintech’s introduction back to the mid-20th century- to the ATMs and credit cards. However, it truly gained ample momentum when users began relying less on physical banks. A new era was born- one of mobile banking apps and digital wallets.

Hence, the way we view, leverage, and interact with money has evolved to some extent. The wealth management industry has now realized that fintech is a complement, not a substitute for traditional advisors.

Here, the blog navigates what fintech’s impact is actually about and why it holds a crucial space in wealth management.

What is Wealth Management?

The tools, actions, and tactics used to improve someone’s financial state or position are referred to as wealth management. It combines investment and portfolio management with financial life planning to achieve specific goals over a period.

There was a vital knowledge gap previously. People assumed that only high-net-worth families, industry leaders, and individuals could afford this financial service.

But the advent of fintech has proved them incorrect. It’s for everyone with a definite financial goal. That’s why we have JPMorgan, Goldman Sachs, and Morgan Stanley today.

Wealth management is basically consulting. Because financial markets are unpredictable, clients wish to manage their portfolio to avoid as much market turbulence as possible. These firms help clients plan out their retirements, accounting and tax, and legal and real estate planning. And curate a personalized fund-allocation strategy under a portfolio.

Not all investments yield expected returns. There’s substantial risk in managing portfolios when you don’t have financial as well as market knowledge. But there’s immense growth potential.

That’s the crux that clients and investors wish to target. And that’s precisely where fintech in wealth management becomes imperative. Especially in overcoming significant challenges that halt clients from gauging the best possible advice regarding their portfolios. And for firms to improve their value offerings.

Challenges such as these:

- data security and privacy (high-value challenge)

- modular coverage across both human and digital touchpoints

- Customers must have better knowledge of investments

- extent of reliability on tech platforms

- pricing of wealth offerings

Fintech in Wealth Management: An Innovation or a Disruption?

Wealth management isn’t just money exchange. And neither is it a simple transaction.

It requires a portfolio-specific, personalized strategy to yield actual returns. And given that there are monetary processes involved, this function comes with greater client expectations:

- Transparency into fee pricing.

- Consistent rules and frameworks.

- Stricter government-instilled wealth management regulations.

These inefficiencies easily drive people out of this business or limit their growth. It has nudged financial institutions to question the adequacy of existing frameworks and the resilience of traditional banking systems.

Wealth management firms must improve their customer experiences. Or they end up in a ditch- losing mindshare. That’s precisely what 80% of investors and clients also prefer.

Because the investor base today wants to zero in on investment opportunities that transcend traditional assets. But very few actually hold any financial literacy.

How do wealth advisors match the expected levels of professional management- from financial planning for the middle class to sophisticated advice for the high-net-worth individuals?

Proactive digital adoption.

For cost-effectiveness. Transparency and control. Personalized investment strategies. Enhanced price-to-value. principles that closely align with how organizations measure and optimize marketing ROI today. That’s how clients choose the firms- they gravitate towards ones that offer them the security, trust, and safety net.

The Innovation

Amidst all the fintech innovations rampant in the market, there are some making huge waves-

Blockchain, AI/ML, and big data analytics. It’s the multi-faceted impact of fintech on wealth management. In fact, AI-driven intelligence is increasingly shaping executive decisions across industries.

And observably, that’s what is imperative today.

Investors want personalized and accessible wealth management services. They have the appetite, just not the access to it. It’s because these clients, especially across Africa, Asia, and Latin America, have never had access to such sophisticated avenues.

Fintech is clearing away these hurdles. It’s eradicating the wealth managers’ dilemma- connecting them to previously untapped capital pools. Much like targeted demand generation unlocks new revenue opportunities.

Think of a mid-sized wealth management firm in Singapore. Its clients are, to a fault, ambitious and resourceful. And quite eager to diversify beyond local equities and bonds. They wish to take a leap of faith towards the venture capital opportunities in Europe and growth equity funds across Silicon Valley.

And they inquire about their wealth manager about this. The answer is always the same echo: a lack of access. Small funds lack track records. The paperwork is always too complex. Or fund allocation is only open for elite players (HNWIs).

This has halted wealth engagement, distribution, and ownership. And concentrated it within a few high-net-worth communities. Creating an inequality in credit and asset ownership.

It’s never been about scarcity. It’s about accessibility- Access parity.

The millennial investors of today, irrespective of class, look to diversify their portfolios into alternatives and seek safety from market volatility.

Fintech across wealth management is granting them that gateway. It’s becoming a norm — a revolution in financial advisory underlined by superior user experiences. Fintech is the missing puzzle to that access.

Fintech is the concrete filling the problem of financial inclusion. And the structural gaps are addressed by abolishing the need for traditional intermediaries and developing a low threshold for entry.

It’s an eager step towards wealth democratization through robo-advisors, mobile payment systems, peer-to-peer lending, and overall decentralization of finance.

There’s intense pressure on wealth advisors. From personal meetings to demand for lower fees and personalized advice, the dynamic client investors’ needs are creating an environment for firms to adopt new tech. With fintech, firms wish to unlock billions in untapped market demand.

- Blockchain: The decentralized, tamper-resistant client ledger that can only be accessed by approved systems. One can merely store and share a golden copy of the clients’ data to retain integrity. You don’t have to store multiple client records. It also fosters real-time portfolio rebalancing without human intervention. Think of when a client’s portfolio deviates from its target due to unpredictable market movements. Blockchain streamlines this.

- Cognitive computing, ML, and AI: This helps extract valuable insights from big data. similar to how AI agents are transforming automated workflows and personalization in modern business ecosystems. And facilitate high-level accuracy and algorithms by diving into heaps of client data and optimizing for higher returns on investment. AI helps predict which assets might potentially be at risk. Additionally, cognitive functions help answer complex client queries in real-time and instill deep personalization, curating investment strategies.

- Robo-advisors: A shift from an advice-based model to an algorithm-based consultancy model. This mirrors how predictive intelligence has replaced traditional scoring frameworks in modern revenue systems. They are automated investment advice providers that help with financial planning based on clients’ risk appetite and cost minimization. Robo-advisors are basically poster children for low-barrier entry, transparent, and low-cost advisory services.

- Embedded automation: Wealth management platforms and apps are being embedded into non-finance platforms, an evolution similar to how SaaS ecosystems are expanding across industries such as Shopify or Uber. Especially to streamline user access.

The incorporation of these tech and more into wealth management is the building block for a hybrid advice model.

What precisely does that look like?

Hybridity of Your Tech-Powered Wealth Management Services

Clients choose advisors for communication. And for emotional resonance. just as customer experience and nurturing play a critical role in long-term business relationships. That’s what drives connections in wealth management.

Personalized and relevant communication elevates confidence in advisors by 77%. And that’s a whopping lot. Meanwhile, a lack of responsiveness is cited as the second fundamental reason for dropping a wealth management advisor.

And often, administrative tasks take away crucial time that could be spent engaging with clients. That’s the door fintech has opened.

Fintech’s adoption in wealth management has helped automate menial and mundane tasks. Especially for advisors to do what they do best- communicate with their clients with trust and patience. From chasing paperwork to comprehensively understanding their financial situation and offering an impressive recommendation.

This is what actual wealth management advice is. The client-advisor relationship is the nucleus of wealth management.

And where investors aren’t happy with digital solutions or the flaws of a robo-advisor, human interaction is what’ll help row their boat. Face-to-face interaction often communicates more value than one can even assume in a broad industry with diverse segments and distinct requirements.

Wealth management today doesn’t boil down to the technicalities. It’s about flexible and tailored solutions that cater to all demographics. Because there’s a deep inclination towards digital interactions, and that’s true. But clients still appreciate personal, face-to-face communication–

“There is a need for digital wealth platforms to be both fully digital and fully human, as clients can switch seamlessly between the digital and human experience. This offers a hyperpersonalized experience that caters to the needs of different clients at different times.”

Fintech in the wealth management industry is no longer a differentiator as it was a decade ago.

From being a nice-to-have, tech in wealth management has become a must-have. Today’s investors, both Gen Z and millennials, are skeptical, cost-conscious, and research-oriented. Their general trust in banks and non-bank financial institutions isn’t at the levels it should be.

“The new generation of investors wants solutions based on their life goals and events- older millennials starting families want to know how they can save up for a house, and Gen Z are looking at the mounting national student loan debt, want to understand how they can pay for college.”

It’s why the wealth management advisory model is crucially built on communication. Because your millennial investors are hesitant, why we discussed the need for a hybrid advisory model.

Because fintech in wealth management is not merely about technological breakthroughs. It’s also about positioning, thought leadership, and building trust in regulated industries And how these emerging technologies integrate into existing traditional models. It trickles down to finding why fintech is a need in wealth management in the very first place-

The client demographics and the segments that actually opt for your financial advice have inherently changed.

It’s a remodeling of wealth management- one where digital tech frees advisors from time-consuming, computationally heavy tasks. And refocuses their priority towards relationship building to instill trust.