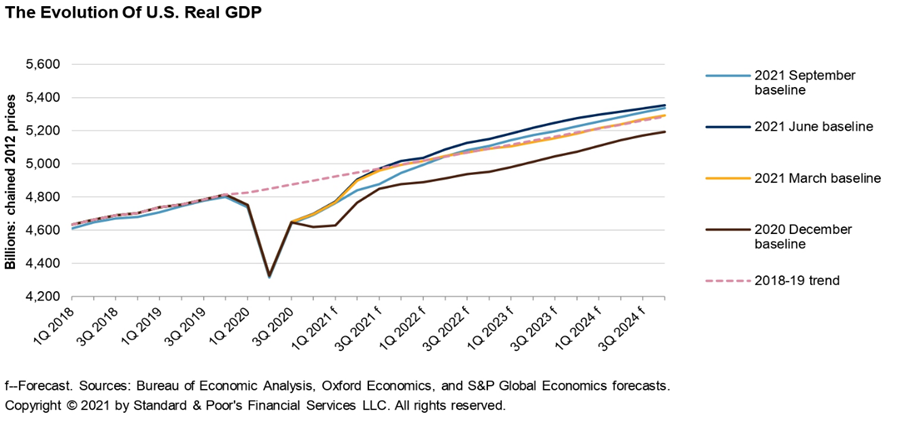

The US economy, a speculative topic for leading economists, witnessed the recent surge in GDP and has bolstered the faith of millions of citizens.

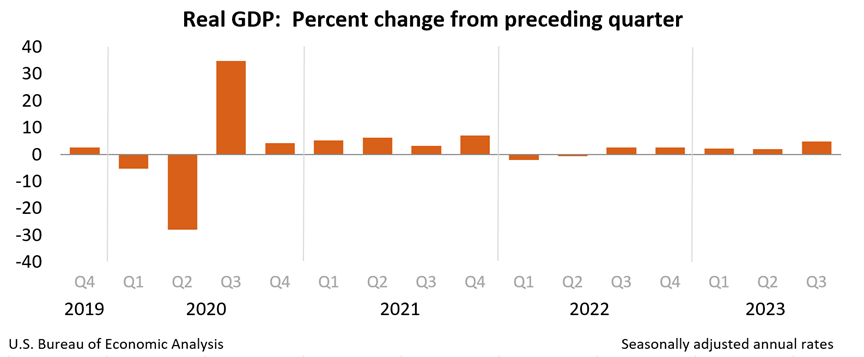

In defiance of the prediction of leading financial analysts about recession, the US economy, powered by the GDP, flourished to 4.9% in the last quarter (July to September). The world’s biggest economy owes its promising financial upsurge to propelling factors and is successfully holding off prospects of a downturn. This fast-paced growth marks the highest rise since the last quarter of 2021. We delve into the contributing factors and break them down to gauge how economies prosper or fail in the economic landscape.

Gross Domestic Product rises from 2.1% to 4.9%

GDP rose by about 133% this quarter from 2.1% in the previous quarter (April through June).

Image Source: https://www.bea.gov/news/2023/gross-domestic-product-third-quarter-2023-advance-estimate

Gross Domestic Product (GDP) can be formulated as the cumulation of consumption, investments, government spending, and the net export of a country.

GDP = C + I + G + (X – M)

Implying:

private consumption + gross private investment + government investment/ government spending + (exports – imports).

For the GDP to increase, the leading contributors are the US consumers, whose spending accounts for over 67% of the economy surged in the last quarter. A tight labor market, despite slow wage growth of about 1.7% in a quarter, favored consumers to spend on various goods and services. The interest rate hikes by the Federal Reserve, keen on clamping down inflation, have not stopped private consumption so far.

As per the survey, some of the leading sectors with the highest expenditure, are housing, utilities including gas and groceries, insurance, financial services, accommodation, food services, recreational goods, vehicles, drugs, and more. This helped the personal consumption expenditures (PCE) price index soar high to 2.9%. With increased personal expenses, personal saving was reported as $776.9 billion in the third quarter, when compared to $1.04 trillion in the second quarter of 2023.

A notable fact that must have propelled the economy is loan repayments. During the pandemic, loan repayments had been desisted, and October witnessed over 30 million loan repayments.

Interestingly, fresh home sales surged by 12.3%, the highest in the last 19 months. This element affirms spending capacity of US consumers as positive for GDP growth.

To contribute towards private investment, there has been improvement in manufacturing and retail trade as per government reports. Export and import are important components driving the economy of a nation. While exports rose by 6.2%, imports improved by 5.7%.

The federal government spends increased in residential fixed investment, further contributing to the boost.

Though several factors listed above supported the country to outpace its revenue dips in the past, this improvement is unlikely to impact the government’s monetary policies.

Predictions for the 4th quarter

The US economy has been a speculative topic and subject to deep analysis by leading economic analysts. If we were to believe few of them, consumers seem to have used the last portion of their pandemic savings. After this boost in GDP, they predict there will again be a downturn in the concluding quarter of 2023. The strikes by United Auto Workers against the

leading conglomerates Ford, Stellantis, and General Motors can hamper the sustenance of

the economy to this level. The strike that ensued on 15th September against underpays and loss of retirement benefits can hamper the automobile manufacturing industry and impact GDP. Finally, the gross national income restoration, is a breath of fresh air for this thriving land of opportunities, and citizens hope this hike stays persistent.